ADARGA RESEARCH INSTITUTE

Research that illuminates the geopolitical and emerging technology landscape

Understand what’s happening, why it’s happening, and what could happen next

The Adarga Research Institute (ARI) delivers robust research on the most important geopolitical and technological issues of our time.

Its analysis is actively helping the UK and its allies to carry out more effective decision making, and in turn develop strategic resilience.

A unique synthesis of expertise, technology, and proprietary data models to deliver in-depth research and analysis

Thanks to a global network of collaborators, proprietary AI, and specialist data sets, the Adarga Research Institute's (ARI’s) researchers are able to dig deeper and faster, and to uncover unique insights that might otherwise be missed.

ACCELERATE INSIGHT WITH A GLOBAL NETWORK OF SUBJECT-MATTER EXPERTS

In today's unpredictable and fast-moving risk landscape, the consequences of missing a threat signal or overlooking an opportunity are severe. Supported by a global network of subject-matter experts, we work alongside organisations including think tanks, governments, private businesses and academic institutions to power deeper, more robust and more cost-effective research. This enables faster, more agile, data-driven planning and decision making. We specialise in geopolitics, as well as emerging technologies that can be applied to drive information intelligence in today's changing world order.

AUGMENT RESEARCH WITH AI-DRIVEN CAPABILITIES

Adarga’s information intelligence software, Vantage, gives our team – and our partners – a unique edge. It allows us to explore the widest possible range of unstructured qualitative data, to work faster, and to gain a depth and breadth of insight that’s only possible through the harnessing of technology. It enables us to work over 20x faster, use 300% more sources and deliver a higher quality of outputs than manual analysis processes.

UNDERSTAND THE LANDSCAPE WITH HIGHLY CURATED, GEOPOLITICAL DATA SETS

Adarga’s proprietary knowledge base comprises unique data sets and use-case-specific models that can be configured specifically to the needs of policy designers, planners, researchers and leaders from across government, defence and industry. Our analytical frameworks ensure organisations can make better-informed plans and policies ahead of time and then act at speed as events unfold. Read more about Adarga's Country Influence Index (CII) below.

Adarga's Proprietary Data Models

Adarga has created multiple data models including its Country Influence Index

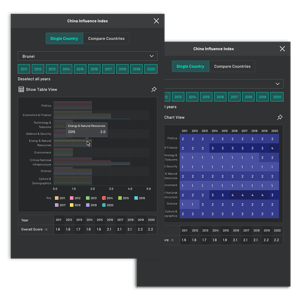

Adarga’s Country Influence Index (CII) comprises data on subjects ranging from politics, natural resources, defence and security to economics and finance, technological innovation, culture and demographics.

The largest curated data set of its kind, it offers unique, quantifiable insights into geopolitical risks ranging from economic prosperity to defensive capacity and government functionality by illuminating how – and to what extent – nations exert their influence on one another.

.png?width=1685&height=1022&name=image%20(1).png)

Adarga's Supply Chain Vulnerability Index (SCVI)

Mitigate geopolitical risk to a supply chain through faster, better-informed decisions.

Using metrics based on supply chain exposure, diversification and market share, and backed by the ARI’s breadth and depth of unique geopolitical experience, the SCVI methodology measures and assesses the vulnerability of not only different types of supply chain, but also different parts within it and from different perspectives.

Case studies

Our focus reflects our customers' and partners' most pressing concerns, ranging from long-term risks relating to the changing international order to narrower, near-term issues around economic resilience.

By bringing an academically rigorous, technologically enabled approach to research and analysis, we reveal the hidden pressure points and fault lines that exist between and among nations. This gives leaders the information and insight they need to understand what’s happening, why it’s happening, and what could happen next – as well as the necessary frameworks for making better-informed plans and policies ahead of time, and faster, data-driven decisions as events unfold.

A deeper understanding of macro supply chain risks

The challenge

The ARI was tasked by a leading US think tank to help them understand the macro supply chain risks in several advanced technology sectors, particularly those relating to an interruption of supply caused by a breakdown in China-US relations.

The conventional way of answering this is through qualitative analysis (particularly looking at political and economic policy), but this approach doesn’t take into account the huge amounts of quantitative data that exists to give far deeper and more rounded insights.

Our solution

The ARI’s in-house team of experts on China-US relations, macro supply chain risk, and geoeconomics has extensive experience analysing supply chains and international competition in emerging technologies. They were able to accelerate and extend the conventional qualitative analysis by employing Vantage to draw on a vast range of multilingual sources – in addition to government sources – to get a more rounded international view of the risks in question.

The team was then able to augment this qualitative research with more objective data-led methodology. They employed models of national influence to better understand the precise dependencies and vulnerabilities across the supply chain, from raw material extraction to component manufacture to the import of finished products, and so derive unique insights including tailored scoring of the dependency and asymmetry of bilateral trade relationships across countries and over time.

The results

The ARI’s analysis identified the significance of production and processing bottlenecks in two different lithium battery supply chains, LFP-dominant (lithium ferrophosphate) in the Chinese domestic market, and NMC-dominant (nickel/manganese/cobalt) outside China.

The ARI analysed the degree of influence and dependence of China and the US on lithium products from Chile, used primarily for LFP batteries, to identify implications for supply chain dependencies as US manufacturers shift to LFP batteries. This was understood in relation to the Chinese government’s prioritisation of the electric-vehicle sector and Chinese and US companies’ efforts to increase vertical integration close to lithium sources.

The ARI’s data-driven supply chain analysis is today enabling more effective, more nuanced policy decisions thanks to its synthesis of dedicated metrics for national influence within supply chains based on quantitative data and qualitative analysis of the technology, as well as the investment landscape and government policy. This analysis goes beyond simplistic measures of a country’s influence over a given supply chain to assess the interdependence of countries and companies at the levels of production, and of bilateral trade in specific commodities throughout the supply chain.

Understanding – and measuring – Chinese influence across Southeast Asia

The challenge

A European government ministry was aiming to get a better, more nuanced understanding of Chinese influence in Southeast Asia and how it evolved over time – and they also wanted it measured.

The first challenge was defining ‘influence’ in a way that’s quantifiable and consistent. The second was developing the relevant metrics for influence that could be reliably formulated for each bilateral relationship based on available data. The third was to adapt these metrics to as comprehensive a range of national activities as possible, from government to trade to digital infrastructure.

Our solution

This was not the first time the team had encountered these challenges. The ARI has developed cutting-edge models of national influence, defined as ‘the capacity for Country A to comprise the autonomous decision-making of Country B’. The ARI’s model quantifies national influence across ten strands of national activity ranging from politics, natural resources, defence and security to economics and finance, technological innovation, culture and demographics. This meant that the ARI’s researchers were able to identify specific dependencies and the asymmetry of relationships, layered with expert qualitative assessments, ensuring both comparability across countries and sensitivity to country-specific circumstances.

Having employed Adarga Vantage to help conduct the widest possible qualitative assessment of the issue of Chinese influence, the team moved on to more quantitative analysis, using its proprietary models and data to measure and understand Chinese influence over ten Southeast Asian countries over a ten-year period. Finally, ARI’s in-house expertise was augmented by its network of internationally recognised subject matter experts from across academia, business and politics.

The results

The results showed an increase in China’s influence across the board, particularly in Cambodia and Laos, and indicated that China’s influence was driving shifts in the regional balance of power.

This included the major role of digital infrastructure projects and technical standards that would tend to lock in dependence on China; the emergence of Indonesia, Malaysia, and Singapore as a regional economic counterweight to China; and resistance to Chinese political influence in the Philippines and Vietnam. The ARI’s scoring system identified a significant increase in Chinese influence over Thailand (economically, militarily, in science and technology, and culturally) following the 2014 coup and the associated diplomatic distancing of the USA.

Since receiving the analysis, the ministry in question has been using it to make better decisions based on a more systematic understanding of China’s relations with Southeast Asia, describing the ARI’s approach and findings as "a blueprint for our work".

A more nuanced approach to balancing national security with economic opportunity

The challenge

Like many Western governments, one ARI customer was facing a major policy challenge – how best to balance national security concerns with its extensive economic engagement with China.

The Institute helped them identify two specific requirements: a replicable framework for decision-making, supported by a dedicated research tool that would facilitate rapid familiarisation with relevant policy areas for experts and non-experts, and allow more effective communication of this across government.

Our solution

The ARI team has deep subject-matter expertise on China’s international economic priorities and Western-China relations, and is able to draw on an international network of experts from industry, policy, and academia. Combined with their close familiarity with using Adarga’s Vantage software for research on China and Western-China relations, this enabled the team to identify what would be required of an effective decision-making framework and illustrate its utility through a case study of China’s Belt and Road Initiative (BRI).

The ARI team was also able to show how Vantage could be effectively deployed across government as a policy-relevant research tool, allowing the user to rapidly search across large volumes of unstructured data from a wide range of English, Chinese and other language sources.

The results

The outputs included a demonstrable workflow for decision-making and associated research based on a dedicated Vantage environment, alongside a report illustrating the model itself. The ARI also provided the Belt Road Initiative case study, which would help others across government understand how to use the frame-work and the research tool, as well as the benefits of doing so in terms of their day-to-day work.

The research yielded a number of unique insights, including a breakdown of Western and Chinese rhetoric around ‘decoupling’ and ‘derisking’, which helped identify key points of political divergence. Overall, the report developed a decision-making framework based on conditions of possibility for specific policy decisions. Taking an original problem statement from the customer regarding the potential for a Western equivalent to China’s Belt and Road Initiative, the team identified the reliance of the BRI on China’s current account surplus and the lack of this on the part of the customer country and its allies. The customer was therefore able to conclude that countering China’s influence via the BRI would not be best facilitated by trying to replicate it.

Having satisfied themselves of the efficacy of both the framework and research tool, the ARI customer has been promoting both across central government customers, generating significant interest in larger-scale adoption.

Key Adarga Research Institute Blogs and Insights

New report: Europe-Asia trade and transport links at risk of being cut off in 52nd Meridian Challenge

AI-Enriched Research Report: Southeast Asia's Emerging Geopolitical Order and China’s Influence

-3.png?width=800&height=600&name=thumbnail%20(1)-3.png)